Accounts Receivable Financing Solution

Deciding to use an accounts receivable loan usually comes at a time of cash-flow bind. Perhaps your company took a big job that required more front-end capital than you anticipated. Maybe there was a snag on a project that required additional funds to complete. Whatever your situation, moving towards an alternative form of finance outside of a traditional bank creates a sense of uncertainty. However, this uncertainty is based more on unfamiliarity than fear of the unknown.

As a client of Camel Financial, we take pride in sharing our knowledge with business owners to help accelerate their growth and maximize the value of their accounts receivable loan. So, as opposed to just covering what your company COULD do with additional cash-flow through an accounts receivable financing solution, we'll highlight what your company SHOULD do. Want more inside information? Call Camel Financial for a free consultation, today!

More interested in what you could do? Check out the other benefits of an accounts receivable financing solution!

Build Credit with Vendors

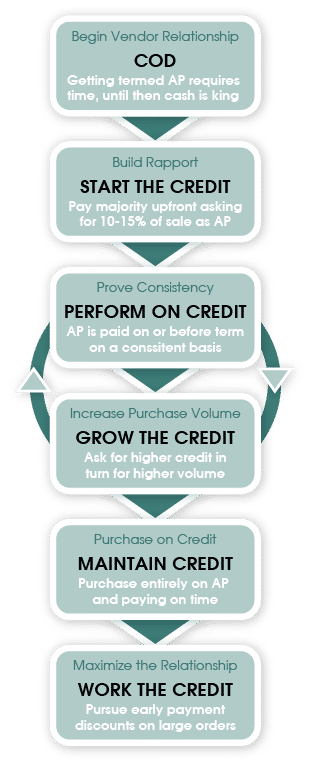

One of the best ways to utilize accounts receivable financing is to build stronger relationships with your vendors through consistent, on-time, or even early payments. Newer businesses struggle to establish credit with vendors due to limited operating history and the risk that is associated with it. And consequently, time and routine performance is the only way to build the supplier relationship. But this reality should not discourage you from pursuing these types of relationships. Growing your accounts payable is INTEREST FREE credit for your business and a win-win situation for both.

Take Advantage of Bulk Purchasing

Larger purchase volume almost always translates into a better deal. However, the size of the order alone will require some type deposit. Once you've built your reputation with your vendors to establish terms, leverage your accounts receivable financing solution to entice them with a larger cash deposit. After that, ensure your meeting the payment terms and follow-up with a move to increase your credit balance with your suppliers. Once you prove your reliability, they'll be jumping at the opportunity to increase their credit sales to your company.

Take Every 2NET10 Available

An early payment discount commonly referred to as a 2NET10 is a cash-flow technique used by vendors. It promises a 2% discount if the invoice pays within 10-days of issuance. After the 10-days expire, so too does the discount. Once you've established a strong vendor relationship as a reliable partner, its time to use that to your company's advantage. By taking early payment discounts, your financing costs through an accounts receivable financing solution are almost completely eliminated.